Satellite Modem Market Size:

Get more information on Satellite Modem Market - Request Sample Report

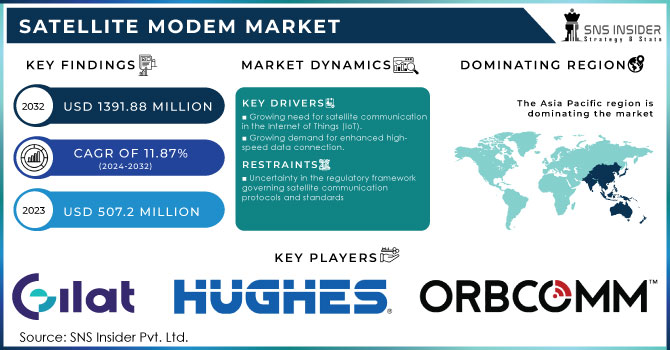

The Satellite Modem Market Size was valued at USD 507.2 million in 2023, and is expected to reach USD 1391.88 million by 2032, and grow at a CAGR of 11.87% over the forecast period 2024-2032.

Satellite modem or satmodem is an advanced communication solution designed to establish data transfer using satellite communication as a transmitter. The main function of a satellite modem is to convert input bitstream input into a radio signal and vice versa. In addition, satellite internet modem is intended to use satellites that are designed to provide communication links between various points around the world. however, the opportunity for the satellite modem market is largely driven by the growing trend of digital digitalization in the Internet of Things Solutions during forecasting.

Satellite Modem Market Dynamics:

KEY DRIVERS:

-

Growing need for satellite communication in the Internet of Things (IoT).

-

Growing demand for enhanced high-speed data connection.

RESTRAINTS:

-

Uncertainty in the regulatory framework governing satellite communication protocols and standards

OPPORTUNITIES:

-

5G commercialization.

-

Satellite networks are being proposed for construction to give internet connectivity in remote places.

CHALLENGES:

-

SATCOM equipment are vulnerable to cybersecurity attacks

Satellite Modem Market Segment Overview:

Based on Channel Type, the satellite modem market is segmented into MCPC modem and SCPC modem. The MCPC channel satellite module market is expected to grow at a high CAGR from 2023 to 2030. The growth of this category is due to the incomparable channel performance provided by these modems, which is a key requirement for high-performance data traffic applications, such as mobile communications, the Internet, and broadband services. MCPC satellite modules can be integrated with IP networks to provide seamless voice, video, and data traffic. Broadband internet services for business networks are possible with MCPC modem technology due to its high data rate over satellite technology.

Based on the Technology, the satellite modem market is segmented into Satcom Automatic Identification System (AIS), VSAT, Satcom-on-the-Move, Satellite Telemetry and Satcom-on-the-Pause. SOTM modem is expected to grow at a high CAGR during the forecasting. Satcom on-the-move (SOTM) terminals are increasingly being used in military and commercial systems. For military purposes, these terminals are primarily used for intelligent communication. SOTM terminals are used for broadband communications by sea ships, trains, planes, land vehicles, and other vehicles. However, in commercial systems, these terminals are mainly used for broadband internet services.

Based on Data Rate, the satellite modem market is segmented into Entry Level, Mid- Range and High Speed. Satellite modem data speed are expected to hold the largest share in the market from 2023 to 2030. This is due to the growing demand for high data and high-bandwidth applications such as mobile & backhaul and offshore connections. Satellite service providers enable internet, mobile, and data networks over long distances. To meet the high demand for data while managing operating costs, high speed data satellite modules are required. In addition, the growing demand from the commercial and military sectors for mobile communications at high data rates is advancing the market for high data satellite modems.

Based on End-User Industry, the satellite modem market is segmented into Energy & Utilities, Mining, Marine, Transportation & Logistics, Telecommunications, Military & Defense, Oil & Gas and Others.

The satellite modem transportation and logistics market are expected to grow at a very high CAGR at the time of forecasting. In transportation and logistics, there is an ongoing need to transfer real-time data, including vehicle location, traffic congestion, video and audio, temperature between rotting vehicles, and emergency notices. To transmit and receive such data, high-speed data satellite modes, which can establish a communication channel between the vehicle and the monitoring center, are used. Satellite modems also increase the accuracy and speed of the Global Positioning System (GPS).

IMPACT OF COVID-19:

The outbreak and spread of COVID-19 have affected the satellite modem market. Many industry experts believe the epidemic will subside by the end of the second quarter of FY2021. Considering the input from various industry experts from different phases of the satellite modem value chain including OEMs, suppliers, end users, and distributors and post-consultation and financing of various companies to the 2020 satellite ecosystem 2020, it. it is estimated that the market size of satellite modem has seen a decrease of 4-5% from 2019 to 2020. In some countries such as the US and the UK, the second wave of COVID-19 has affected the performance of satellite module companies due to the closure of manufacturing facilities. A few companies have experienced delays in potential order awards and order delays for US military customers. In the satellite modem market, COVID-19 has had a significant impact on the maritime and aviation industries.

Satellite Modem Market Regional Analysis:

The satellite modem market in APAC is expected to grow at a very high CAGR from 2023 to 2030. This market will be driven by a growing demand for metals such as steel for complex industrial use. China, Japan, South Korea, and India are expected to operate the satellite modem market at APAC. China remains the largest market for satellite modems and is expected to remain dominant during the forecast period. Investments in increasing glass production and government support for steel production are set to provide greater opportunities for the APAC satellite module market.

Get Customized Report as per your Business Requirement - Request For Customized Report

KEY PLAYERS:

The key players in the satellite modem market are Gilat Satellite Networks, Hughes Network Systems, ORBCOMM, Novelsat, Comtech Telecommunications, Datum System, ST Engineering, Teledyne Technologies, Viasat, Work Microwave & Other Players.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 507.2 Mn |

| Market Size by 2032 | US$ 1391.88 Mn |

| CAGR | CAGR of 11.87% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Channel Type (MCPC Modem, SCPC Modem) • By Technology (Satcom Automatic Identification System (AIS), VSAT, Satcom-On-The-Move, Satellite Telemetry, Satcom-On-The-Pause) • By Data Rate (Entry Level, Mid-Range, High Speed) • By Application (Mobile & Backhaul, IP Trunking, Tracking & Monitoring, In-Flight Connectivity, Offshore Communication, Enterprise & Broadband, Media & Broadcast, Others) • By End User Industry (Energy & Utilities, Mining, Marine, Transportation & Logistics, Telecommunications, Military & Defense, Oil & Gas, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Gilat Satellite Networks, Hughes Network Systems, ORBCOMM, Novelsat, Comtech Telecommunications, Datum System, ST Engineering, Teledyne Technologies, Viasat, and Work Microwave. |

| Key Drivers | • Growing need for satellite communication in the Internet of Things (IoT). • Growing demand for enhanced high-speed data connection. |

| Restraints | • Uncertainty in the regulatory framework governing satellite communication protocols and standards. |